nc estimated tax payment safe harbor

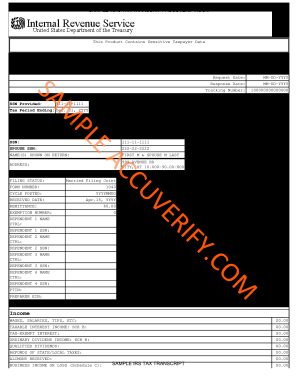

Income tax you expect to owe for the year. If your adjusted gross income for the year is over 150000 then you must pay at least 110 of last years taxes.

Estimated Tax Payments For Independent Contractors A Complete Guide

The question is if.

. Individual estimated income tax. The question is if paying this year estimated taxes and covering prior years tax. Article 4C Filing of Declarations of Estimated Income Tax and Installment Payments of Estimated Income Tax by Corporations.

This safe harbor is generally 100 of the prior years tax liability. The safe harbor rules are as follows. You can also pay your estimated tax online.

Skip auxiliary navigation Press Enter. Safe Harbor Rules. Income Tax Return for Electing Alaska Native Settlement Trusts.

The North Carolina General Assembly offers access to the General Statutes on the Internet as a service to the public. Business income tax estimated tax payments are payments of tax that are generally required. If you follow these methods you wont be subject to additional interest and penalties even if you still owe tax when you file your return.

Want to schedule all four payments. Schedule payments up to 60 days in advance. Pay individual estimated income tax.

When I do my 2020 tax return I will see I owe 14500 in federal taxes 22000 - 7500. PDF 49105 KB - January 24 2022. About Form 1041-T Allocation of Estimated Tax Payments to Beneficiaries.

Safe harbor on estimated taxes Richard Margelefsky 01-21-2014 1150 AM. Schedule payments up to 60 days in advance. Fig Tree Care Uk How To Pronounce Pansy Fire In His Fingertips Characters Syrian Hamster For Sale Job Opportunities For Electrical Engineers Freshers All Grown Up Wiki 8 Inch Double Wall Stove Pipe Cap Fallout 4 Concord.

Estimated Income Tax is the amount of income tax you expect to owe for the year after subtracting the amount of tax you expect to have withheld and. If you do youll owe penalties 14 to 1 of the amount owed for each month it is owed and interest at the rate of the federal short-term rate currently around 025- plus 3. North carolina safe harbor estimated tax.

For details visit wwwncdorgov and search for online file and pay For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and. If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe. For calendar year filers estimated payments are due April 15 June 15 and September 15 of the taxable year and January 15 of the following year.

Pick up the paper form at one of our service centers. If you expect to owe less than 1000 after subtracting your withholding youre safe. While every effort is made to ensure the accuracy and completeness of the statutes the North Carolina General Assembly is not.

About Form 1041-N US. What is individual estimated income tax. About Form 8822-B Change of Address or Responsible Party - Business.

The estimated safe harbor rule has three parts. If youre estimating a down year so long as you pay within 90 of your actual liability for the current year you. The IRS says that for most taxpayers if your estimated tax payments equal at least 90 of the total that you ended up.

Would that prevent an under payment penalty onfiling the return when you stil Skip to main content Press Enter. Information about Form 1041-ES Estimated Income Tax for. The estimated tax Safe Harbor rule is based on 110 percent of the tax shown on the clients tax return.

You owe less than 1000 in tax after subtracting. There are two safe harbors. The safe harbor rule of estimated tax payments.

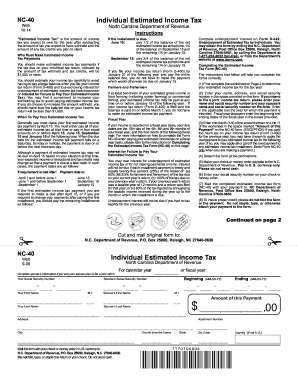

Nc estimated tax payment safe harbor. You cant just wait until April 15th and pay your tax bill. Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax.

Use eFile to schedule payments for the entire year. If your previous years adjusted gross income was more than 150000 or 75000 for those who are married and filing separate returns last year you will have to pay in 110 percent of your previous years taxes to satisfy the safe-harbor requirement. Individual Estimated Income Tax.

If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe. Make one payment or. The IRS will not charge you an underpayment penalty if.

Estimated tax safe harbor. If your adjusted gross income for the year is over 150000 then its 110. The IRS has safe harbor methods for calculating your estimated tax payments.

2022 Form NC-40pdf. PO Box 25000 Raleigh NC 27640-0640. You pay at least 90 of the tax you owe for the current year or 100 of the tax you owed for the previous tax year or.

Instructions for Form NC-40 North Carolina Individual Estimated Income Tax. If your adjusted gross income AGI was less than 150000 last year then youll need to make quarterly estimated payments. What are business income tax estimated tax payments.

North carolina safe harbor estimated tax. But you can make a big payment on April. If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe.

You must pay estimated tax payments for returns with taxable income of 50000 or more. The tax application calculates this amount automatically when you are using estimate option 1 3 or 7 in the Estimates. Generally an underpayment penalty can be avoided if you use the safe harbor rule for payments described below.

Enter information on the ncest screen to. To pay individual estimated income tax. Estimated payments are made quarterly according to the following schedule.

If your adjusted gross income for. Suppose your tax for the year is 10000 and your prepayments total 5600. I will pay the 14500 to the feds on April 2021 but I will not pay any.

Income tax you expect to owe for the year. Statutory 35 ILCS 5803 and 804 for corporations other than S corporations 35 ILCS 5201p9 for pass-through entities electing to pay pass-through entity PTE tax Regulations 1008000 and 1008010. This applies to taxpayers with adjusted gross income greater than 150000 or 75000 if married filing separately.

The tax system is a pay-as-you-go system. If I pay a single 2020 estimated tax payment of 2500 I would achieve paying federal taxes that would be equal to my total tax liability in 2019 ie 500025007500.

How To Calculate Quarterly Estimated Taxes In 2021 1 800accountant

Tangible Property Regulations Safe Harbor Elections In Drake Software

Understanding Individual Estimated Income Tax Payments And Safe Harbors Dermody Burke Brown Cpas Llc

Economic Nexus Laws By State Taxconnex

North Carolina Estimated Tax Payments Fill Out And Sign Printable Pdf Template Signnow

How To Calculate Estimated Taxes The Motley Fool

Nc Quarterly Taxes Fill Online Printable Fillable Blank Pdffiller

Safe Harbor For Underpaying Estimated Tax H R Block

Taxnewsflash Digital Economy Kpmg Global

What If You Haven T Paid Quarterly Taxes Mybanktracker

Quick And Dirty Payroll For One Person S Corps Evergreen Small Business

What Does The March 1 Deadline Mean For Farmers Center For Agricultural Law And Taxation

Nc Quarterly Taxes Fill Online Printable Fillable Blank Pdffiller

Quarterly Estimated Tax Payments What You Need To Know

Instructions For Form 1040 Nr 2021 Internal Revenue Service

Nc Quarterly Taxes Fill Online Printable Fillable Blank Pdffiller